Shareholders Wealth Formula . learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Deducting total liabilities from total assets or. the formula for calculating shareholders' equity is: Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Determine the company's earnings per share. here's how to compute your portion of shareholder value: learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Learn how to calculate it and how to. Add the company's stock price to. shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Find out the factors that affect. learn how to measure the return of an investment in a company by subtracting preferred dividends from net. shareholders' equity is the net worth of a company, which is the amount that would be returned to shareholders if assets were liquidated.

from studylib.net

shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. here's how to compute your portion of shareholder value: learn how to measure the return of an investment in a company by subtracting preferred dividends from net. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Learn how to calculate it and how to. Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. the formula for calculating shareholders' equity is: learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Add the company's stock price to. Deducting total liabilities from total assets or.

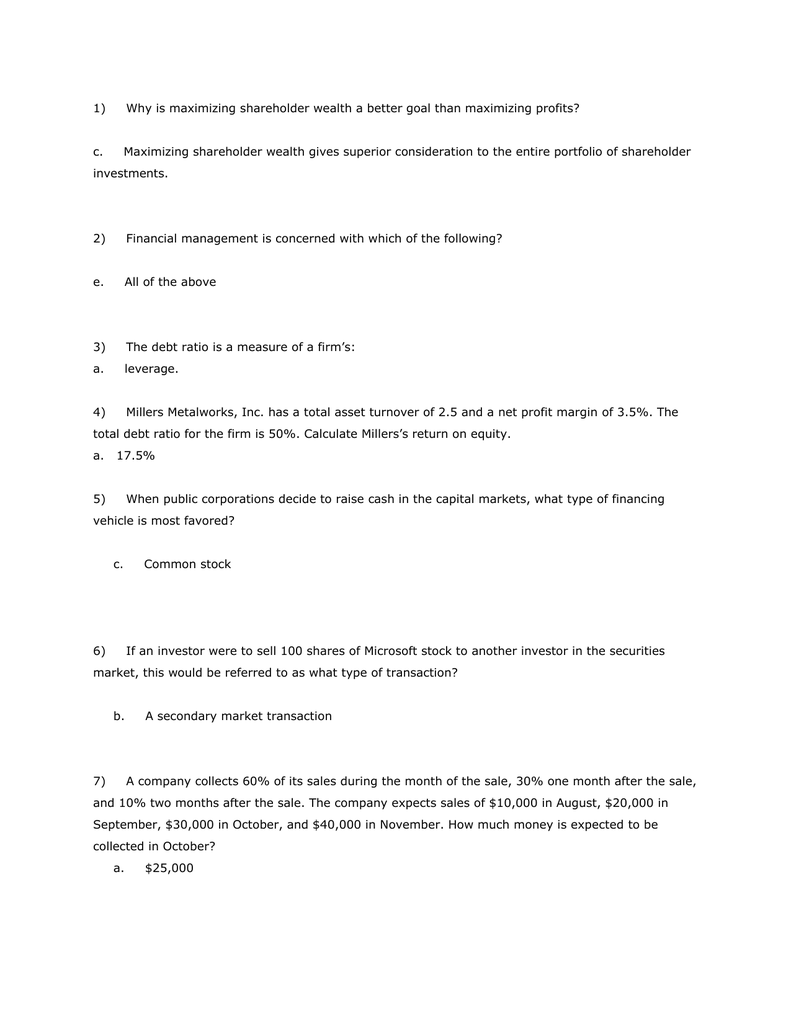

1) Why is maximizing shareholder wealth a better goal than

Shareholders Wealth Formula Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Determine the company's earnings per share. the formula for calculating shareholders' equity is: Add the company's stock price to. shareholders' equity is the net worth of a company, which is the amount that would be returned to shareholders if assets were liquidated. shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Deducting total liabilities from total assets or. Find out the factors that affect. Learn how to calculate it and how to. learn how to measure the return of an investment in a company by subtracting preferred dividends from net. here's how to compute your portion of shareholder value: learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's.

From www.youtube.com

1 4 Shareholder Wealth Maximization YouTube Shareholders Wealth Formula Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Find out the factors that affect. Deducting total liabilities from total assets or. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: the formula for calculating shareholders' equity is: Add the company's stock price to. Determine the company's earnings per share. Learn how to calculate it. Shareholders Wealth Formula.

From articles-junction.blogspot.com

Articles Junction Shareholders Wealth Maximization Advantages Shareholders Wealth Formula Determine the company's earnings per share. the formula for calculating shareholders' equity is: Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Learn how to calculate it and how to. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: shareholder value is the financial benefit that a company’s shareholders gain from holding its stock.. Shareholders Wealth Formula.

From www.educba.com

Shareholder vs Stakeholder Top 10 Differences to Learn with Infographics Shareholders Wealth Formula shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Deducting total liabilities from total assets or. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Learn how to calculate it and how to. Find out the factors that affect. Add the company's stock price to. the formula for calculating. Shareholders Wealth Formula.

From www.wholewealthmanagement.com

Overview — Whole Wealth Management Shareholders Wealth Formula Deducting total liabilities from total assets or. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. here's how to compute your portion of shareholder value: Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. shareholders' equity is the net worth of a company, which is the. Shareholders Wealth Formula.

From www.researchgate.net

(PDF) Shareholders wealth and mergers and acquisitions (M&As) Shareholders Wealth Formula learn how to measure the return of an investment in a company by subtracting preferred dividends from net. Add the company's stock price to. the formula for calculating shareholders' equity is: Find out the factors that affect. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Deducting. Shareholders Wealth Formula.

From www.slideserve.com

PPT Corporate Investment and Shareholder Wealth PowerPoint Shareholders Wealth Formula Determine the company's earnings per share. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. here's how to compute your portion of shareholder value: Add the company's stock price to. Find out the factors that affect. Deducting total liabilities from total assets or. the formula for calculating. Shareholders Wealth Formula.

From www.youtube.com

Merger and Shareholders Wealth YouTube Shareholders Wealth Formula Add the company's stock price to. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Determine the company's earnings per share. Find out the factors that affect. Learn how to calculate it and how to. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. learn. Shareholders Wealth Formula.

From www.youtube.com

Shareholder Wealth Maximization YouTube Shareholders Wealth Formula shareholders' equity is the net worth of a company, which is the amount that would be returned to shareholders if assets were liquidated. shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. learn how to measure the return of an investment in a company by subtracting preferred dividends from net. . Shareholders Wealth Formula.

From studylib.net

1) Why is maximizing shareholder wealth a better goal than Shareholders Wealth Formula Learn how to calculate it and how to. Find out the factors that affect. here's how to compute your portion of shareholder value: shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Add the company's stock price to. Determine the company's earnings per share. shareholders' equity is the net worth of. Shareholders Wealth Formula.

From www.researchgate.net

(PDF) Shareholders wealth and mergers and acquisitions (M&AS) Shareholders Wealth Formula Add the company's stock price to. shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. shareholders' equity is the net worth of a company, which is the amount that would be returned to shareholders if assets were liquidated. Deducting total liabilities from total assets or. Determine the company's earnings per share. . Shareholders Wealth Formula.

From www.shutterstock.com

3 Maximizing Shareholder Wealth Images, Stock Photos & Vectors Shareholders Wealth Formula Learn how to calculate it and how to. the formula for calculating shareholders' equity is: Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Deducting total liabilities from total assets. Shareholders Wealth Formula.

From marketbusinessnews.com

What is shareholder value? Definition and meaning Market Business News Shareholders Wealth Formula Find out the factors that affect. here's how to compute your portion of shareholder value: learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Add the company's stock price to. Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Determine the company's earnings per share. learn how to measure the return of an investment. Shareholders Wealth Formula.

From www.bdc.ca

What is shareholders’ equity? BDC.ca Shareholders Wealth Formula Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Deducting total liabilities from total assets or. Learn how to calculate it and how to. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: Add the company's stock price to. the formula for calculating shareholders' equity is: here's how to compute your portion of shareholder. Shareholders Wealth Formula.

From freshclarity.co.uk

Shareholders Agreement Fresh Clarity Shareholders Wealth Formula Add the company's stock price to. learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Determine the company's earnings per share. learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: shareholders' equity is the net worth of a company, which is the amount that would. Shareholders Wealth Formula.

From blog.shoonya.com

Everything You Must Know About Shareholder Equity Shareholders Wealth Formula learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Determine the company's earnings per share. learn how to measure the return of an investment in a company by subtracting preferred dividends from net. Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. learn how to calculate. Shareholders Wealth Formula.

From vintti.com

Shareholder Value Maximization Finance Explained Shareholders Wealth Formula shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. the formula for calculating shareholders' equity is: learn how to calculate shareholder’s equity (stockholder’s equity) using two methods: learn how to calculate and create shareholder value, the financial worth owners of a business receive for owning shares. Learn how to calculate. Shareholders Wealth Formula.

From www.youtube.com

Maximize Shareholder Wealth Goal of the Business Firm Explained Shareholders Wealth Formula Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. Add the company's stock price to. Deducting total liabilities from total assets or. here's how to compute your portion of shareholder value: shareholder value is the financial benefit that a company’s shareholders gain from holding its stock. Determine the company's earnings per share. Find out the factors that. Shareholders Wealth Formula.

From www.acowtancy.com

CIMA F3 Notes B1b. Total Shareholder Return aCOWtancy Textbook Shareholders Wealth Formula learn how to measure the return of an investment in a company by subtracting preferred dividends from net. Shareholder’s equity = total assets − total liabilities \begin{aligned} &\text{shareholder's. the formula for calculating shareholders' equity is: Learn how to calculate it and how to. shareholders' equity is the net worth of a company, which is the amount that. Shareholders Wealth Formula.